Understanding auto body shop insurance requirements is essential for legal compliance and risk mitigation. US states mandate specific coverage levels protecting shops against property damage, personal injury, and legal claims. Essential policies include general liability, collision, mechanical work liability, comprehensive property, and business interruption insurance to safeguard against diverse risks unique to the industry.

“In the dynamic landscape of automotive repair, ensuring adequate coverage is non-negotiable. This comprehensive guide navigates the intricate web of auto body shop insurance requirements by state and region. From understanding essential policies to deciphering state-mandated covers, this article serves as your definitive resource.

Unravel the differences in coverage mandates across diverse locations and empower yourself with knowledge. Whether you’re a seasoned professional or a fledgling business owner, mastering these intricacies is paramount for smooth operations and financial security.”

- Understanding Auto Body Shop Insurance Requirements

- State-by-State Coverage Mandates Explained

- Essential Policies for Auto Body Shops: A Regional Guide

Understanding Auto Body Shop Insurance Requirements

Understanding Auto Body Shop Insurance Requirements is a critical step for any business in this industry. Each state or region has its own set of regulations and standards that dictate what level of coverage auto body shops must carry. These requirements not only protect the shop and its employees but also ensure consumer safety and satisfaction. Proper insurance can safeguard against unexpected liabilities, such as damages caused by faulty repairs or accidents involving customers’ vehicles.

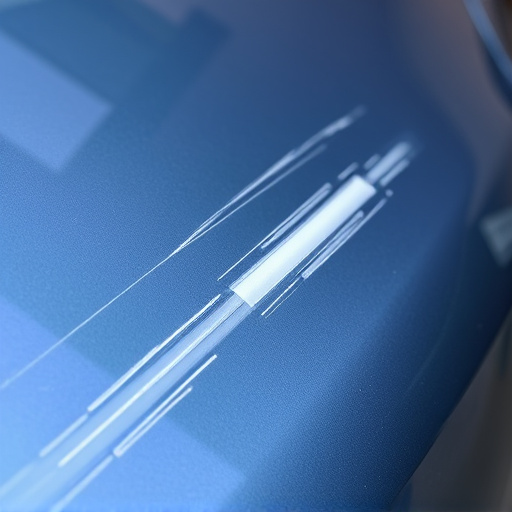

When it comes to auto body shop insurance, businesses should consider comprehensive coverage options that include property damage liability, general liability, and workers’ compensation. Vehicle restoration and car paint services, like Mercedes Benz repair, often require specialized equipment and materials, making it essential for shops to have adequate insurance to cover potential losses or accidents related to these services. Understanding and adhering to the specific insurance requirements of your state or region is paramount for running a successful and legally compliant auto body shop.

State-by-State Coverage Mandates Explained

In the United States, each state has its own set of regulations and requirements when it comes to auto body shop insurance, reflecting the diverse needs and risks across regions. These mandates ensure that collision repair centers are adequately protected against potential liabilities and losses stemming from their operations, including property damage, personal injury, and legal claims. The specific coverage required varies widely, with some states adopting comprehensive standards while others leaving more room for individual shops to tailor their policies.

Understanding these state-by-state mandates is crucial for auto body shop owners when determining their insurance needs. For instance, certain regions may mandate broader liability coverage to account for higher risk factors, such as dense urban areas with heavy traffic. In contrast, rural states might have less stringent requirements due to lower collision rates. Regardless of location, a well-rounded auto body shop insurance policy should include liability protection against third-party claims and comprehensive coverage for the shop’s own equipment and inventory, as well as potential losses arising from natural disasters or vandalism—essential considerations for any collision repair center or car body repair shop.

Essential Policies for Auto Body Shops: A Regional Guide

In the realm of auto body shops, ensuring adequate insurance coverage is non-negotiable, as it protects against potential risks and liabilities unique to the industry. Essential policies for auto body shops include general liability insurance, which covers property damage and personal injuries occurring on premises. This is crucial for any business dealing with vehicle repair, as accidents can lead to significant financial and legal repercussions. Additionally, comprehensive property insurance safeguards businesses from losses due to fire, theft, or vandalism, common threats in bustling workshops where valuable equipment and materials are stored.

Specific to auto body shops, collision coverage and mechanical work liability are indispensable. Collision insurance protects against damages caused by accidents involving insured vehicles, while mechanical work liability covers repairs and their potential aftereffects. Given the intricate nature of autobody repairs, these policies safeguard against unexpected issues arising from misdiagnosis or faulty workmanship. Furthermore, business interruption insurance is highly recommended, ensuring financial stability during periods of operation halt due to covered events, allowing for a swift return to service once claims are settled.

When operating an auto body shop, understanding and adhering to local insurance requirements is paramount. This guide has provided a comprehensive overview of auto body shop insurance, detailing state-by-state mandates and essential policies. By navigating these regulations, business owners can ensure they provide the necessary protection for their operations, employees, and customers. Investing in the right coverage is crucial for the long-term success and sustainability of any auto body shop, enabling them to thrive in a competitive market.