Auto body shop insurance rates are influenced by location factors like natural disasters, crime, traffic congestion, and regional regulations. Shop size, equipment, and claims history also play significant roles. Larger shops with specialized tools face higher costs, while a clean claims history and financial stability lead to lower premiums, enabling investments in quality services.

Auto body shop insurance rates are influenced by a multitude of factors. In this guide, we’ll explore the key elements that impact your premiums. Location plays a significant role due to varying local risk factors, from climate to crime rates. Shop size, equipment investments, and facility safety also matter. Additionally, claims history and the financial stability of your business are crucial considerations. Understanding these aspects will empower auto body shop owners to make informed decisions and secure competitive insurance coverage.

- Location and Local Risk Factors

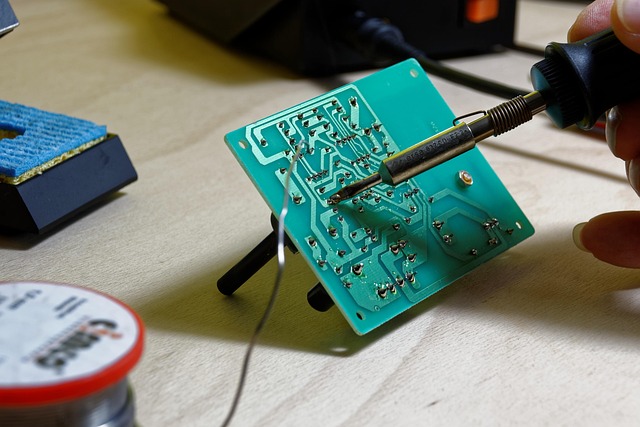

- Shop Size, Equipment, and Facilities

- Claims History and Financial Stability

Location and Local Risk Factors

The location of your auto body shop plays a significant role in determining your insurance premium rates. Areas prone to natural disasters like hurricanes or earthquakes often face higher risks, leading to more frequent claims and, consequently, higher costs for insurance providers. Similarly, regions with high crime rates or areas known for automotive theft may result in increased premiums due to the potential for more damage-related incidents and claims.

Local risk factors also include traffic congestion and proximity to major highways. Shops situated in heavily trafficked zones might experience a higher frequency of accidents involving vehicles, leading to more repair work and claims. Conversely, rural areas with fewer vehicles on the road may have lower insurance rates. Additionally, local regulations and building codes can influence premiums; strict guidelines for fire safety or specific structural requirements might increase operational costs for auto body shops, which are then reflected in insurance pricing.

Shop Size, Equipment, and Facilities

The size of an auto body shop is a significant factor in determining insurance premium rates. Larger shops with more space typically face higher premiums due to increased liability and potential risks associated with larger operations. This includes extra equipment, tools, and inventory that could be susceptible to damage or theft. Moreover, bigger facilities often require more advanced safety measures and fire suppression systems, which can drive up insurance costs.

The type and quality of equipment in a vehicle body shop play a crucial role in insurance pricing. Specialized tools for tasks like welding, painting, and auto body repair are considered valuable assets. Insurers assess the risk based on the capacity and condition of these tools, as well as the overall facilities’ safety features. For instance, a shop specializing in classic car restoration might have unique equipment requiring specialized coverage. The infrastructure and layout of the shop also matter; modern, well-maintained facilities with up-to-date safety systems are generally more appealing to insurers.

Claims History and Financial Stability

Your claims history is a significant factor in determining your auto body shop insurance premium rates. The number and severity of previous claims can greatly impact the cost of your coverage. If your business has a history of frequent or costly collision damage repair (auto body services) and vehicle dent repair claims, insurers may perceive you as a higher risk. This could result in higher premiums to offset potential future losses. Conversely, a clean claims history demonstrates financial stability and responsible operating practices, which can lead to more favorable insurance rates.

Financial stability is another crucial aspect that plays into your auto body shop’s (auto body services) insurance costs. Insurers assess the financial health of businesses to ensure they can cover potential claims. A solid financial foundation, reflected in stable revenue, low debt, and positive cash flow, indicates a lower risk profile. This financial stability can translate into better rates on your auto body shop insurance, allowing you to invest more in equipment, training, and other aspects that enhance the quality of your collision damage repair services.

Understanding what influences auto body shop insurance premium rates is vital for business owners aiming to secure affordable coverage. Location, shop infrastructure, and claims history are key factors that underwrite policy costs. By considering these aspects, shop owners can make informed decisions, implement necessary improvements, and find the best value for their auto body shop insurance needs.