Auto body shop insurance rates are influenced by location, local regulations, shop size and equipment, claims history, and the type of work performed. Urban areas with high crime rates and rural regions with extended emergency response times have varying insurance costs. Strict environmental, waste disposal, or safety regulations can further increase expenses. Larger shops with cutting-edge technology face higher costs due to increased liability. Specialized services carry higher premiums due to enhanced risk. A clean claims history indicates lower risk and more favorable insurance rates.

“Unraveling the factors that shape your auto body shop’s insurance premium is essential for smart business owners. This article serves as a comprehensive guide, shedding light on the key elements driving insurance rates. From the strategic placement of your shop to the equipment you rely on and the claims history you’ve accumulated, each aspect plays a pivotal role in determining your coverage costs. Understanding these factors empowers business leaders to make informed decisions regarding their auto body shop insurance.”

Location and Local Regulations

The location of your auto body shop plays a significant role in determining your insurance premium rates. Shops in urban areas or regions with high crime rates often face higher premiums due to the increased risk of theft, vandalism, and accidents. On the other hand, rural locations might enjoy lower rates, but they also have their challenges, such as longer response times for emergency services. This is where local regulations come into play; some cities or towns have specific requirements for auto body shops, including security measures or reporting protocols that can impact your insurance costs.

In addition to these geographical factors, local laws and regulations regarding car repair services and luxury vehicle repair specifically can influence insurance rates. Strict guidelines on waste disposal, environmental protection, or employee safety might require certain levels of coverage, adding to the overall premium. Understanding these nuances is crucial when managing the financial aspects of running an auto body shop, ensuring compliance while minimizing insurance expenses.

Shop's Size, Equipment, and Facilities

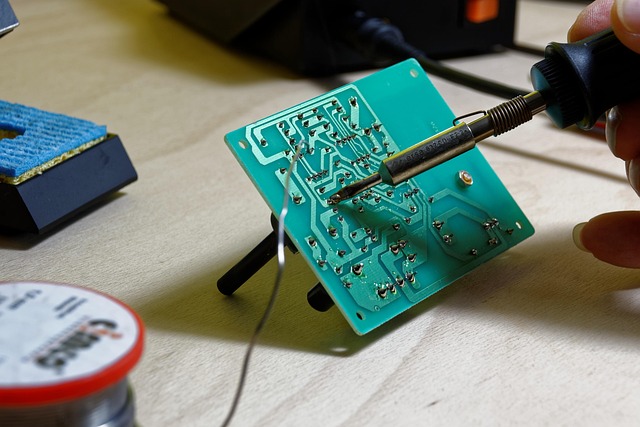

The size, equipment, and facilities of an auto body shop play a significant role in determining its insurance premium rates. Larger shops with more extensive facilities and cutting-edge technology often face higher insurance costs due to increased liability and potential risks. These shops may employ specialized tools like paintless dent repair systems or advanced collision repair equipment for Mercedes Benz vehicles, which require specific coverage to protect against mechanical failures or faulty repairs.

Moreover, the type of work performed at the shop influences insurance rates. Specialized services such as autobody repairs for luxury cars or complex restoration projects attract higher premiums due to the increased risk of damage and potential legal liabilities. Insurance companies assess these factors to ensure they accurately reflect the shop’s capabilities and associated risks, ultimately shaping the cost of their auto body shop insurance policies.

Claims History and Frequency

Your claims history and frequency play a significant role in determining your auto body shop insurance premium rates. Insurance companies meticulously review past claims to assess risk levels. The more claims an auto body shop has, especially for extensive repairs or multiple occurrences within a short period, the higher the perceived risk. This can lead to increased insurance costs as underwriters factor in the likelihood of future losses.

Each claim, whether it’s for car repair services, auto glass replacement or other auto body work, is carefully evaluated. Frequent claims suggest consistent issues or potentially shoddy workmanship, both of which can raise rates. Conversely, a clean claims history demonstrates responsible management and lower risk, often resulting in more favorable insurance premium rates.

Understanding what influences your auto body shop insurance premium rates is key to managing costs effectively. Factors such as location and local regulations, shop size, equipment, and facilities, as well as claims history and frequency, all play a significant role in determining your coverage costs. By carefully considering these aspects, you can make informed decisions to optimize your insurance expenses while ensuring adequate protection for your business.