Running an auto body shop requires specific insurance to shield your business and employees from potential risks, including worker injuries and property damage. Prioritize policies offering comprehensive protection for work-related incidents, medical expenses, lost wages, and legal responsibility. For specialized operations like Mercedes-Benz repair, consider specific coverage for rare or high-end vehicles. Tailor your auto body shop insurance to create a safety net addressing your facility's unique risks, ensuring compliance and mitigating unforeseen incidents.

- Understanding Auto Body Shop Insurance Requirements

- Key Coverage Areas for Employee Injuries

- How to Choose the Right Insurance Policy

Understanding Auto Body Shop Insurance Requirements

Running an auto body shop involves a lot more than providing top-notch vehicle repair services and body shop services. It’s crucial to understand and comply with specific insurance requirements to protect your business and employees. Auto body shop insurance is designed to cover a range of potential risks and liabilities that arise in the automotive industry, including employee injuries.

When considering auto body shop insurance, focus on policies that offer comprehensive coverage for work-related accidents. This includes medical expenses, lost wages, and legal responsibility for any damage or harm caused to employees during their work. Given the nature of vehicle repair services and the potential use of heavy machinery in body shop services, ensuring adequate insurance is not just a legal requirement but also a smart business decision to safeguard against unexpected incidents.

Key Coverage Areas for Employee Injuries

When considering auto body shop insurance that covers employee injuries, understanding the key coverage areas is paramount. The primary focus should be on workers’ compensation insurance, which provides medical benefits and wage replacement for employees injured on the job. This is a legal requirement in most jurisdictions and ensures that auto body shop staff receive the care they need without incurring significant personal financial burdens.

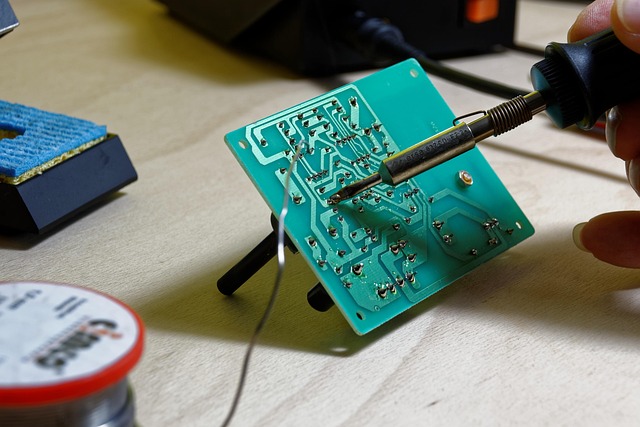

Additionally, general liability insurance plays a crucial role, protecting against claims of property damage or personal injury to non-employees, such as customers or passersby. This coverage extends beyond the workshop itself, encompassing any activities related to auto body services and repairs. For specialized operations like Mercedes-Benz repair, ensuring that your policy includes specific coverage for rare or high-end vehicles is essential, as these may require specialized parts and techniques not commonly encountered in standard auto bodywork.

How to Choose the Right Insurance Policy

When selecting auto body shop insurance that covers employee injuries, it’s crucial to choose a policy that aligns with your business needs and provides adequate protection. The first step is assessing the risks specific to your collision center or vehicle body repair facility. Consider factors like the size of your operation, number of employees, types of vehicles handled, and common procedures performed. These considerations will help you determine the appropriate coverage limits for both property damage and worker’s compensation.

Research different insurance providers and their offerings to find a policy that offers comprehensive protection. Look for auto body shop insurance plans that specifically cater to the unique challenges faced by these businesses. Ensure the policy includes provisions for medical expenses, lost wages, and legal responsibilities arising from employee injuries sustained on the job, including during vehicle collision repair processes. By carefully evaluating your options and tailoring your coverage, you can create a safety net that safeguards your business and employees alike.

When running an auto body shop, prioritizing employee safety and ensuring adequate coverage is paramount. The right auto body shop insurance policy protects your business from financial losses arising from employee injuries sustained on the job. By understanding the specific requirements and key coverage areas, you can make informed decisions to select a policy that suits your needs. Remember, choosing the right insurance is a crucial step in fostering a safe work environment and safeguarding your business’s future.